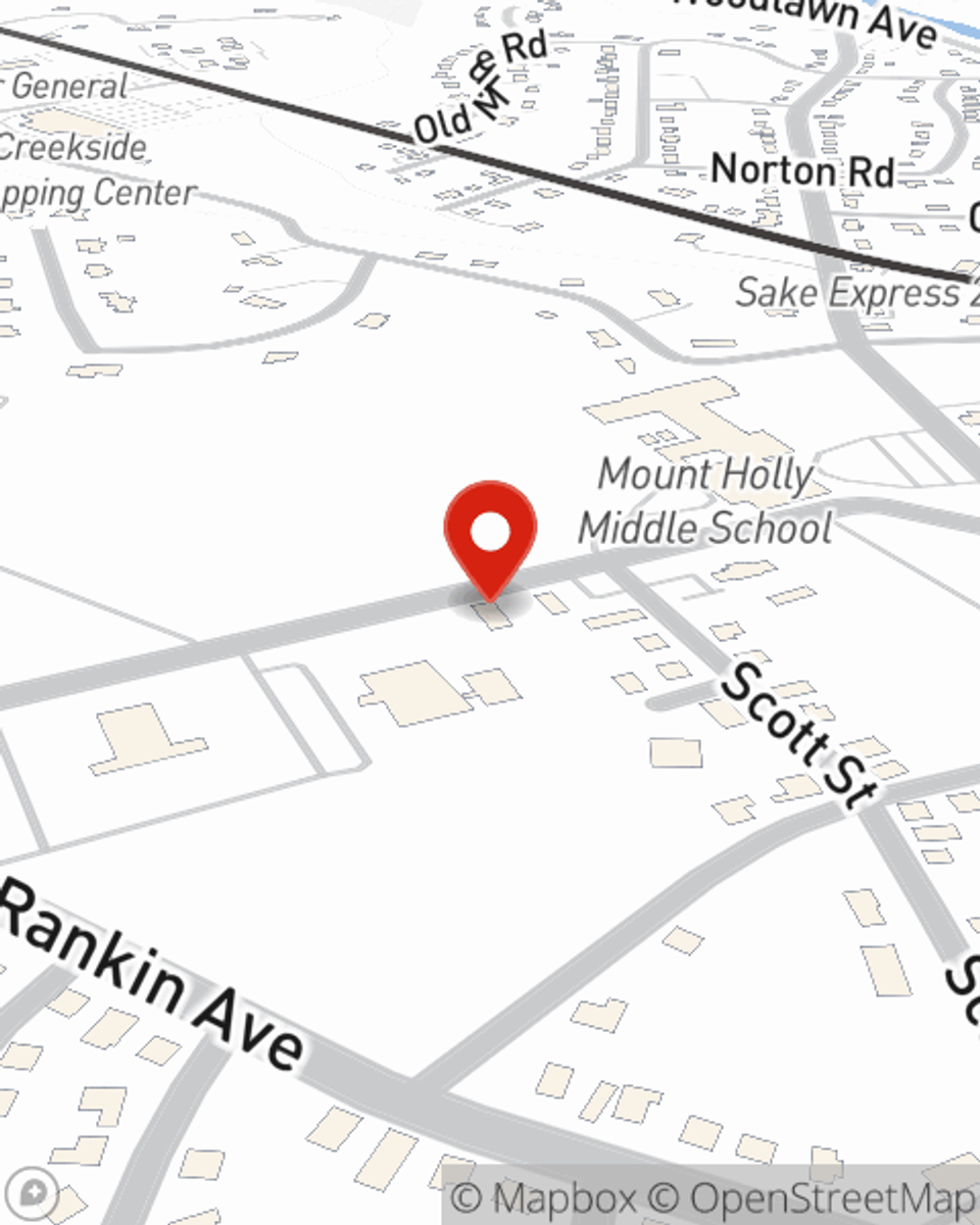

Business Insurance in and around Mount Holly

Calling all small business owners of Mount Holly!

Cover all the bases for your small business

This Coverage Is Worth It.

Do you own a domestic cleaning service company, a home improvement store or a toy store? You're in the right place! Finding the right coverage for you shouldn't be risky business so you can focus on navigating the ups and downs of being a business owner.

Calling all small business owners of Mount Holly!

Cover all the bases for your small business

Strictly Business With State Farm

Your business thrives off your commitment tenacity, and having fantastic coverage with State Farm. While you make decisions for the future of your business and support your customers, let State Farm do their part in supporting you with artisan and service contractors policies, worker’s compensation and commercial auto policies.

As a small business owner as well, agent Katherine Patrick understands that there is a lot on your plate. Call or email Katherine Patrick today to review your options.

Simple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Katherine Patrick

State Farm® Insurance AgentSimple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.